Are you in search of an option that is very flexible and at the same time will help you to profit and be covered with insurance? Turn no corner, Unit Linked Insurance Plans (ULIPs) are the solution. ULIPs are an investment tool which combines the features of investment and protection. Since they offer these features, they have become popular among investors in India. Here, in this article, we have an interesting look at why should i invest in ulip as an investment option right now.

1. Wealth Creation with Market-linked Returns:

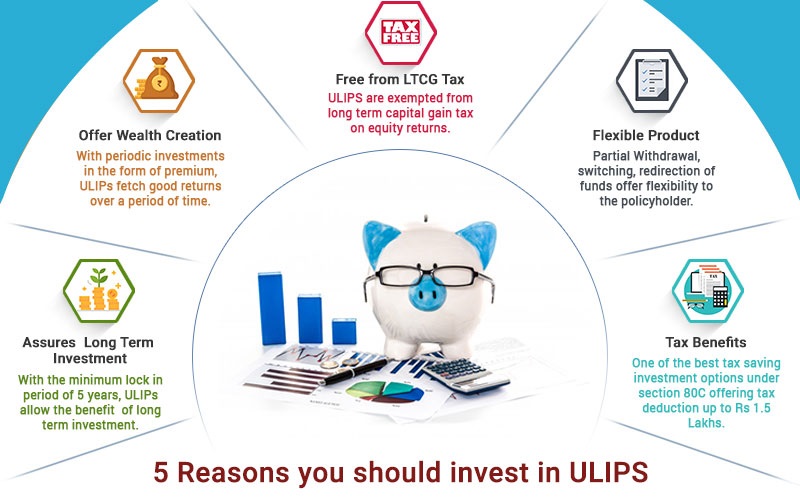

Why should I put my money in the ULIP scheme? In addition, the investment in the stock market can be one of the main reasons due to the accumulation of wealth through the market-related income. ULIPs is not only the name but also the nature of the investment which means that ULIPs have a wide range of investment funds including equity, debt, and balanced funds. Those can be tailored in accordance with your risk appetite and financial goals. With your investment in ULIPs you are presented with a chance for participation in the growth potential of the financial markets and production of nice returns over the long term.

2. Tax Benefits Under Section 80C:Tax Benefits Under Section 80C:

Another reason why ULIPs should be considered as an investment tool is the lucrative tax benefits they provide under section 80C of the Income Tax Act. The sum equal to the premium paid in respect of ULIPs is exempted from tax up to Rs. 1.As compared to an annual income of 5 lakh, we can help you reduce your tax liability and simultaneously invest for your future. In addition to that, ULIPs maturity is tax free under Section 10(10D) so they are an excellent tax saving investment option for wealth creation.

3. Flexibility and Customization:

ULIP is a type of insurance and investment plan that combines two main features, insurance and investment. ULIPs provide for the most all-round and customised flexibility that is suitable for your continually evolving needs and investment preferences. You are at liberty to select the frequency of your payment of premiums, which funds you intend to invest in, top up, and also make decisions on how best to allocate your money based on your risk profile. It is this flexibility that allows you to modify your ULIPs so that they reflect your specific needs and the time horizon till which you want to invest.

4. Insurance Coverage and Financial Protection:Insurance Coverage and Financial Protection:

ULIPs not only offer investment opportunities but also give much needed insurance cover for the beloved ones in case of an accident. A part of your ULIP premiums is spent on a life cover, with the purpose of making sure that your family will be provided with financial aid in case you die unexpectedly. Thus, this unique combination of investment and insurance makes ULIPs a holistic solution for long-term financial planning and risk management.

5. Transparency and Disclosures:

With regard to investment choices, transparency and disclosure are extremely vital in that they contribute to building confidence and trust. ULIPs are regulated by IRDAI or Insurance Regulatory and Development Authority of India which is the authority responsible for the insurance industry in the country. All insurers must adhere to the guidelines set by this authority pertaining to the disclosure of charges, expenses, and fund performance. As an investor in India, you can access the details of the ULIP charges, fund performance, and policy benefits which makes your decision making better towards your investments.

Conclusion:

The fact that ULIPs give you a wonderful opportunity to achieve your financial aspirations with confidence and peace of mind makes them stand out among other plans because of their unique features and a potential for long-term growth. With the possibility of getting exposed to numerous options there is no better time to put your money in ULIPs.